Gold May be Climbing Back on Track

Well, I am back and almost on track again. It is good to get away for a break, but great to be back again.

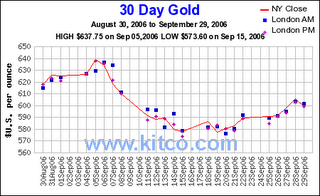

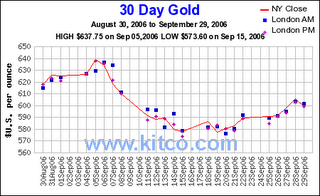

First, your attention is called to the 30-Day Gold Chart from Kitco.com. Notice that since September 22nd. Gold has been trading in a tight range from about $590 to $605. That is a higher level than during the previous two weeks. This could be the early beginning of the fall/winter rally. Almost all of the mining stocks are again moving up, albeit, slowly. It is a bit early to tell, and we have had a good bit of news about central banks playing their game of gold bashing by reporting gold sales. Yes, they are still at it. However, it is difficult to blame them. Were the public to realize the lie of paper currencies, they would be out of business. Yes, they are businesses. I hope you realize that the Federal Reserve is owned by the member banks. What a beautiful racket they have! Produce dollars out of thin air, lend them to governments, other banks, businesses, and individuals and collect interest. We could do it too, but the government would call that counterfeiting and put us in jail.

There is no doubt in my mind, because the evidence clearly shows that the dollar direction is down over time. It will take more dollars to buy everything as the supply is increased. Thus, we must seek the wealth preservation of precious metals and things which are necessary to sustain life.

John Pugsley wrote a book called "Alpha Strategy". It was an interesting book with a sound principle. During times of inflation, people begin to realize that everything will cost more in the future. His strategy was to buy necessities in bulk on sale at every opportunity. Then store them for use over time. Each time the prices of those items increased, you would have saved the difference. Not a bad approach.

Applying this principle while in Tennessee in about 1980, paper towels and toilet paper were at an extremely good bargain price during one of my trips into town. Therefore, I went to the store and bought multiple packages of both. The idea was really great as we had an abundance of storage space on the "farm". However, I was driving a small Opel Kadet station wagon at the time. Loading all of the paper into the wagon was a job, but I managed it. Then came the task of driving home. There was barely enough room for me to get into the drivers seat. I can even now see the sight as viewed by the other drivers. How they must have laughed! I would have too, but driving and barely seeing out was all I could do at the time. Even that paid off during the next few years. Yes, we even moved some when we relocated in 1984.

The principle is sound, so it is likely wise to prudently lay up non-perishables for the future if inflation is on the horizon.

The often asked question is whether we should expect a recession or inflation. I believe the Federal Reserve and the USG are totally against recessions. Even if our economy slows further, as seems likely, the money spigots will again be opened full blast early on. The extra supply of unbacked currency (which is in traditional economic terms inflation) will result in price inflation. I believe that in the mean time we will continue with John Mauldin's "Stagflation". We will continue to muddle through.

Continue to rest in the Lord. He is in control of all and works everything according to His plan. Remember not a Sparrow falls or a hair from your head without His will and knowledge. He really pays constant attention to every detail. Study His word, the Bible, and prepare your self for all of life.

Best to each, Doug

First, your attention is called to the 30-Day Gold Chart from Kitco.com. Notice that since September 22nd. Gold has been trading in a tight range from about $590 to $605. That is a higher level than during the previous two weeks. This could be the early beginning of the fall/winter rally. Almost all of the mining stocks are again moving up, albeit, slowly. It is a bit early to tell, and we have had a good bit of news about central banks playing their game of gold bashing by reporting gold sales. Yes, they are still at it. However, it is difficult to blame them. Were the public to realize the lie of paper currencies, they would be out of business. Yes, they are businesses. I hope you realize that the Federal Reserve is owned by the member banks. What a beautiful racket they have! Produce dollars out of thin air, lend them to governments, other banks, businesses, and individuals and collect interest. We could do it too, but the government would call that counterfeiting and put us in jail.

There is no doubt in my mind, because the evidence clearly shows that the dollar direction is down over time. It will take more dollars to buy everything as the supply is increased. Thus, we must seek the wealth preservation of precious metals and things which are necessary to sustain life.

John Pugsley wrote a book called "Alpha Strategy". It was an interesting book with a sound principle. During times of inflation, people begin to realize that everything will cost more in the future. His strategy was to buy necessities in bulk on sale at every opportunity. Then store them for use over time. Each time the prices of those items increased, you would have saved the difference. Not a bad approach.

Applying this principle while in Tennessee in about 1980, paper towels and toilet paper were at an extremely good bargain price during one of my trips into town. Therefore, I went to the store and bought multiple packages of both. The idea was really great as we had an abundance of storage space on the "farm". However, I was driving a small Opel Kadet station wagon at the time. Loading all of the paper into the wagon was a job, but I managed it. Then came the task of driving home. There was barely enough room for me to get into the drivers seat. I can even now see the sight as viewed by the other drivers. How they must have laughed! I would have too, but driving and barely seeing out was all I could do at the time. Even that paid off during the next few years. Yes, we even moved some when we relocated in 1984.

The principle is sound, so it is likely wise to prudently lay up non-perishables for the future if inflation is on the horizon.

The often asked question is whether we should expect a recession or inflation. I believe the Federal Reserve and the USG are totally against recessions. Even if our economy slows further, as seems likely, the money spigots will again be opened full blast early on. The extra supply of unbacked currency (which is in traditional economic terms inflation) will result in price inflation. I believe that in the mean time we will continue with John Mauldin's "Stagflation". We will continue to muddle through.

Continue to rest in the Lord. He is in control of all and works everything according to His plan. Remember not a Sparrow falls or a hair from your head without His will and knowledge. He really pays constant attention to every detail. Study His word, the Bible, and prepare your self for all of life.

Best to each, Doug

0 Comments:

Post a Comment

<< Home