CK Out Plenty "Money" - Gold vs. Dollar - Obamacare

Below are two more graphs to compare. The first is Hecla Mining which is primarily in silver and the second is Harmony Gold which is primarily in gold. The first shows the stronger pattern with the price above both averages and the price in an ascending trough. The second (Harmony) shows that the 50 day average has just passed upward through the 200 day average. It has a positive series of higher lows. Adding to the difference is the fact that Harmony is a South African company, many which have faced injuries and labor opposition in the recent past. Harmony must better the price of 10.00 to be on its way upward again.

Below are two more graphs to compare. The first is Hecla Mining which is primarily in silver and the second is Harmony Gold which is primarily in gold. The first shows the stronger pattern with the price above both averages and the price in an ascending trough. The second (Harmony) shows that the 50 day average has just passed upward through the 200 day average. It has a positive series of higher lows. Adding to the difference is the fact that Harmony is a South African company, many which have faced injuries and labor opposition in the recent past. Harmony must better the price of 10.00 to be on its way upward again. Both of these are among my core holdings and I like both companies. However, it does seem that silver may be in for a bigger near term upward boom than gold. I would not depend upon these two to decide, because there are other factors. I do like both of these and favor Hecla, because it is into silver and sells at a lower price enabling one to buy more shares for better leverage as the prices rise.

More on the manipulators from The Daily Pfennig today:

More on the manipulators from The Daily Pfennig today:"What UBS is referring to here is the Quantitative Easing (QE)... And they feel that the dollar would be taken to the woodshed if the Fed decides to implement more QE...WOW! 47% of the Treasuries were bought by the Federal Reserve to mask the lack of foreign interest in more of our debt. The day is coming when the FR will be the only buyer: the buyer of last resort through the bullion bank manipulators. Is that day here now?

OK, apparently, the strategist at UBS that wrote the note to Bloomberg, doesn't read the Pfennig! For had he read it, he would have known that the Fed has taken to what I call, "stealth QE"... Recall that on Monday, I told you about a story by Chris Martenson (yes, my fat fingers on Monday typed Mortenson, UGH!) that revealed the plan that the Primary Dealers and the Fed put in place for the last auction of 7-year Treasuries. The Primary Dealers bought the bonds that nobody else wanted, and then a couple of days later, the Fed bought 47% of the purchased bonds by the Primary Dealers! (emphasis added)

So... I guess, in the end, if most traders don't read the Pfennig (boy, they don't know what they're missing! HA!), then I guess this thought about more QE might hold some water... But, here's the rub... If the Fed can effectively buy back from the Primary Dealers what the rest of the world didn't want, without announcing it to the world, why then, would they announce it? It's all a shell game folks... With the cartel, I mean, the Fed Reserve in control...

Speaking of the cartel, I mean the Fed Reserve... Their FOMC meets today... And wouldn't it be nice if we could wake up in the morning when the day was new, and see that the FOMC came clean and told everyone that they bought 47% of the Primary Dealers 7-year Treasuries after the last auction? Yeah, right, if you believe that will happen then I'm sure the Gov't has some land it would like to sell you..."

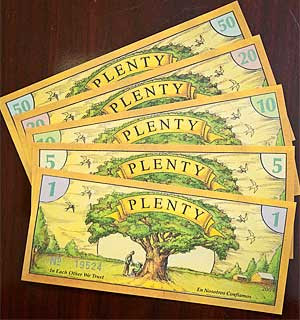

Here is an article on "Plenties" from the LA Times:

Local currencies cash in on recession

Local currencies cash in on recessionA few dozen local businesses banded together this spring to distribute the Plenty -- a local currency intended to replace the dollar. Now 15,000 Plenties are in circulation here, used everywhere from the organic food co-op to the feed store to, starting this month, the Piggly Wiggly supermarket. (We had Piggly Wigglys in San Antonio years ago. Doug)

Read it HERE.

They are really expressing their trust in the Federal Reserve and the spendthrift government we have, are they not?

From one of my favorite Economist, Walter E. Williams in TownHall.com:

Aug. 12 (Bloomberg) -- Honda Motor Co., is backing hydrogen power for the cars of the future, waving aside a decision by the Obama administration to drop the so-called fuel-cell technology in favor of battery-run vehicles.

“Fuel-cell cars will become necessary,” said Takashi Moriya, head of Tokyo-based Honda’s group developing the technology. “We’re positioning it as the ultimate zero-emission car.” Read it HERE.

And who knows who the winner will be? I certainly don't, but still like BYD (BYDDF) the Chinese company deep into batteries and soon electric cars. I believe that hydrogen is a bit farther off than electric.

From Bloomberg.com:

U.S. Economy: Trade Gap Widens Less Than Forecast on Exports

By Bob Willis

Aug. 12 (Bloomberg) -- The U.S. trade deficit widened less than forecast in June, reflecting a second consecutive gain in exports spurred by a pick-up in economies around the world.

The gap increased 4 percent to $27 billion from $26 billion in May, which was the lowest level in almost a decade, Commerce Department figures showed today in Washington. Exports gained 2 percent, helped by stronger demand for goods such as semiconductors and aircraft engines, while imports rose 2.3 percent, led by a higher cost for oil. Read it HERE.

If things are so rosy, why does the Fed have to intervene into markets and use stealth methods deceive the public? If the recession is lessening, why is unemployment so high? Why are inventories being sold and not replaced? Why does general bear market rally seem to be approaching a sell off? I hope the worst is over, but I remain unconvinced at present.

From the Heritege Foundation Morning Bell:

Obamacare Pep Rally Fact Check

Any doubts that President Barack Obama’s “townhall” in Portsmouth, New Hampshire yesterday was a complete farce were dispelled early on when the hand picked crowd broke out in a chant of: "Yes we can! Yes we can!" at the close of his opening remarks. Recognizing his campaign’s signature slogan, the President responded: “Thank you. I remember that.” Comforted knowing he was surrounded by a room full of die-hard supporters, President Obama then want on to make a number of misleading and outright false statements about the health care legislation still working it’s way through Congress. Here are just seven: Read the complete report HERE.

Well, it seems that Obama has taken heed to the resentment expressed against Obamacare at town hall meetings by other elected officials. He now has each meeting packed with hard core supporters to pad his ego. These are not meeting for the local people, but exclusively for supporters. Check out the article to see other signs of deception.

Have a great Wednesday! The markets are very volatile, and seeking direction. The Dow is +122 now, and the miners are as follows: AUY 9.04; CEF 11.92; DROOY 7.53; GLD 92.96; HL 3.03; HMY 9.18; IAG 11.80; SLW 9.78; SSRI 17.82, and VGZ 1.78. Most of the miners and metal trusts are up for the day.

It's always a great day with the Lord. Make it a good day for yourself by trusting in Him.

Best, Doug

0 Comments:

Post a Comment

<< Home