Boyz At Work Yesterday & Today - Interposition

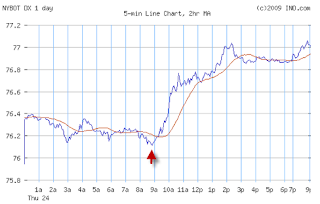

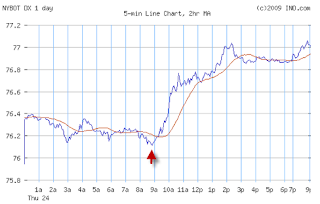

The graph, below, is from Ed Steer's Gold & Silver Daily this morning. He points out clearly the action of the boyz as the intervention continues. It is interesting that the rise in the dollar is almost precisely at the same time as the drop yesterday in the price of our precious metals. This is flagrant intervention in our face by the Fed Reserve and its bullion bank proxies.

The above dollar graph is from yesterday, but the timing is clearly indicated by yesterday's red traces on the graphs for gold and silver. Note that today's green traces have a similar, but not as exaggerated volatility.

The above dollar graph is from yesterday, but the timing is clearly indicated by yesterday's red traces on the graphs for gold and silver. Note that today's green traces have a similar, but not as exaggerated volatility.

Thus, the metals are artificially down again. We must learn to hold tight while this manipulation continues. From all indications, we may see a low in the metals before the middle of October. I would expect to see a low by October 13th. It could come as early as the first seven days of October. This should provide further buying opportunity in preparation for the next run up to beyond 1030 which we could see as early as the near the end of December based on some cyclical projections. However, as I take some precautions, such as, selling and trailing stops, I will not sell all. Too often, I have done so in the past and then been on the side lines as the prices jumped day after day. BYDDF is giving us a buying opportunity again today with last trade at 8.67. BULM last trade was 0.69. Both are holding to most of the recent gains very well. The DOW is up about 15 to 9721 and change. We may see a an up Friday here. Time will tell. In the meantime, hold tightly to most of the mining stocks for the gold rush which is coming. Don't be left on the side lines wishing you had not sold all. Been there and done that with little joy. Of course, our true joy comes from the Lord of all, King Jesus. Chuck Butler in the Daily Pfennig pointed out this morning that the G-8 has given way to the G-20 to admit the BRIC. These "emerging" nations have vast populations and a vast holding of US Treasury dollar securities. Thus, they are a growing financial power in the world. The G-20 gives them a say and more influence which they have earned. At the same time, this lessens the prestige and power of America and our dollar. This will have a positive impact upon the price of precious metals in dollars.

Thus, the metals are artificially down again. We must learn to hold tight while this manipulation continues. From all indications, we may see a low in the metals before the middle of October. I would expect to see a low by October 13th. It could come as early as the first seven days of October. This should provide further buying opportunity in preparation for the next run up to beyond 1030 which we could see as early as the near the end of December based on some cyclical projections. However, as I take some precautions, such as, selling and trailing stops, I will not sell all. Too often, I have done so in the past and then been on the side lines as the prices jumped day after day. BYDDF is giving us a buying opportunity again today with last trade at 8.67. BULM last trade was 0.69. Both are holding to most of the recent gains very well. The DOW is up about 15 to 9721 and change. We may see a an up Friday here. Time will tell. In the meantime, hold tightly to most of the mining stocks for the gold rush which is coming. Don't be left on the side lines wishing you had not sold all. Been there and done that with little joy. Of course, our true joy comes from the Lord of all, King Jesus. Chuck Butler in the Daily Pfennig pointed out this morning that the G-8 has given way to the G-20 to admit the BRIC. These "emerging" nations have vast populations and a vast holding of US Treasury dollar securities. Thus, they are a growing financial power in the world. The G-20 gives them a say and more influence which they have earned. At the same time, this lessens the prestige and power of America and our dollar. This will have a positive impact upon the price of precious metals in dollars.

From Ed Steer's Gold & Silver Daily: "The other thing that was going on in the silver world yesterday, that was below everyone's radar screen, involved the huge short position that the SLV ETF managers currently have. As I mentioned on several occasions, Ted Butler felt the SLV ETF was owed about 30 million ounces. When the bullion banks were covering their short positions on the Comex, the SLV managers were [at the same time] covering their short positions in SLV shares... because they couldn't get the metal, they're forced to short their own shares. If the price correction is deep enough [courtesy of JPMorgan, the biggest silver short on the planet, who just happens to be the custodian of all the silver in the SLV], then the fund can cover its short position and not have to deliver a single ounce of metal into the fund... which they don't have [and can't get] without driving the price to the moon. Ain't this grand???"

The shorts hanging over our precious metals are a risk to us, as the writers of these shorts are anxious to manipulate the price of silver lower to cover the shorts. At some time, maybe not too far away, they might have to cover their liabilities. This can't be done without obscene upward price movement like has never before been seen. Silver could be the very big winner. Think CDE, HL, SLW, PAAS, and SSRI. By the way, I am not a seller of HL. I did get stopped out on a few shares, but am looking to replace even those few and add to the portfolios.

The Constitution of these United States places the states in between the citizens of the states and the Federal Government. By the way, do not forget that the Constitution put limitations upon the powers of the Federal Government, and specifically left all other powers to the citizens and the states in the 10th Amendment. Thus, the states were to interposition themselves to protect the life, liberty, and property of the citizens from violation by the Federalies. There is a movement which has been joined by about 30 states which have enacted 10th Amendment resolutions in an attempt to regain their inter positioning authority under the 10th. This is a baby step in the correct direction. Pray that other states will step forward and that the juggernaut of the current trend will be stopped before all of our Constitution is lost. Our forefathers developed the republican form of government based upon biblical principles and, though not perfect, it was one of the best Constitution ever written by men. We must pray that God will raise up statesmen working to restore our Constitution before it is too late. We, today, stand under the judgment of God, through which God is calling us to national repentance. This is critically important. Repentance must begin with the individual spread to the family, to the church, to the local communities, to the states, and then to the federal level. It must be a bottom up revival. Pray to this end!

Here are our miners from Scottrade streaming quotes:

Gold is 990.20 and silver 16.14.

Gold is 990.20 and silver 16.14.

Best to each, Doug

The above dollar graph is from yesterday, but the timing is clearly indicated by yesterday's red traces on the graphs for gold and silver. Note that today's green traces have a similar, but not as exaggerated volatility.

The above dollar graph is from yesterday, but the timing is clearly indicated by yesterday's red traces on the graphs for gold and silver. Note that today's green traces have a similar, but not as exaggerated volatility.

Thus, the metals are artificially down again. We must learn to hold tight while this manipulation continues. From all indications, we may see a low in the metals before the middle of October. I would expect to see a low by October 13th. It could come as early as the first seven days of October. This should provide further buying opportunity in preparation for the next run up to beyond 1030 which we could see as early as the near the end of December based on some cyclical projections. However, as I take some precautions, such as, selling and trailing stops, I will not sell all. Too often, I have done so in the past and then been on the side lines as the prices jumped day after day. BYDDF is giving us a buying opportunity again today with last trade at 8.67. BULM last trade was 0.69. Both are holding to most of the recent gains very well. The DOW is up about 15 to 9721 and change. We may see a an up Friday here. Time will tell. In the meantime, hold tightly to most of the mining stocks for the gold rush which is coming. Don't be left on the side lines wishing you had not sold all. Been there and done that with little joy. Of course, our true joy comes from the Lord of all, King Jesus. Chuck Butler in the Daily Pfennig pointed out this morning that the G-8 has given way to the G-20 to admit the BRIC. These "emerging" nations have vast populations and a vast holding of US Treasury dollar securities. Thus, they are a growing financial power in the world. The G-20 gives them a say and more influence which they have earned. At the same time, this lessens the prestige and power of America and our dollar. This will have a positive impact upon the price of precious metals in dollars.

Thus, the metals are artificially down again. We must learn to hold tight while this manipulation continues. From all indications, we may see a low in the metals before the middle of October. I would expect to see a low by October 13th. It could come as early as the first seven days of October. This should provide further buying opportunity in preparation for the next run up to beyond 1030 which we could see as early as the near the end of December based on some cyclical projections. However, as I take some precautions, such as, selling and trailing stops, I will not sell all. Too often, I have done so in the past and then been on the side lines as the prices jumped day after day. BYDDF is giving us a buying opportunity again today with last trade at 8.67. BULM last trade was 0.69. Both are holding to most of the recent gains very well. The DOW is up about 15 to 9721 and change. We may see a an up Friday here. Time will tell. In the meantime, hold tightly to most of the mining stocks for the gold rush which is coming. Don't be left on the side lines wishing you had not sold all. Been there and done that with little joy. Of course, our true joy comes from the Lord of all, King Jesus. Chuck Butler in the Daily Pfennig pointed out this morning that the G-8 has given way to the G-20 to admit the BRIC. These "emerging" nations have vast populations and a vast holding of US Treasury dollar securities. Thus, they are a growing financial power in the world. The G-20 gives them a say and more influence which they have earned. At the same time, this lessens the prestige and power of America and our dollar. This will have a positive impact upon the price of precious metals in dollars. From Ed Steer's Gold & Silver Daily: "The other thing that was going on in the silver world yesterday, that was below everyone's radar screen, involved the huge short position that the SLV ETF managers currently have. As I mentioned on several occasions, Ted Butler felt the SLV ETF was owed about 30 million ounces. When the bullion banks were covering their short positions on the Comex, the SLV managers were [at the same time] covering their short positions in SLV shares... because they couldn't get the metal, they're forced to short their own shares. If the price correction is deep enough [courtesy of JPMorgan, the biggest silver short on the planet, who just happens to be the custodian of all the silver in the SLV], then the fund can cover its short position and not have to deliver a single ounce of metal into the fund... which they don't have [and can't get] without driving the price to the moon. Ain't this grand???"

The shorts hanging over our precious metals are a risk to us, as the writers of these shorts are anxious to manipulate the price of silver lower to cover the shorts. At some time, maybe not too far away, they might have to cover their liabilities. This can't be done without obscene upward price movement like has never before been seen. Silver could be the very big winner. Think CDE, HL, SLW, PAAS, and SSRI. By the way, I am not a seller of HL. I did get stopped out on a few shares, but am looking to replace even those few and add to the portfolios.

The Constitution of these United States places the states in between the citizens of the states and the Federal Government. By the way, do not forget that the Constitution put limitations upon the powers of the Federal Government, and specifically left all other powers to the citizens and the states in the 10th Amendment. Thus, the states were to interposition themselves to protect the life, liberty, and property of the citizens from violation by the Federalies. There is a movement which has been joined by about 30 states which have enacted 10th Amendment resolutions in an attempt to regain their inter positioning authority under the 10th. This is a baby step in the correct direction. Pray that other states will step forward and that the juggernaut of the current trend will be stopped before all of our Constitution is lost. Our forefathers developed the republican form of government based upon biblical principles and, though not perfect, it was one of the best Constitution ever written by men. We must pray that God will raise up statesmen working to restore our Constitution before it is too late. We, today, stand under the judgment of God, through which God is calling us to national repentance. This is critically important. Repentance must begin with the individual spread to the family, to the church, to the local communities, to the states, and then to the federal level. It must be a bottom up revival. Pray to this end!

Here are our miners from Scottrade streaming quotes:

Gold is 990.20 and silver 16.14.

Gold is 990.20 and silver 16.14.Best to each, Doug

0 Comments:

Post a Comment

<< Home