Markets in Crash Mode - Long Term or Temporary???

We are being treated to markets which seem to be in a virtual crash mode. Below is the DOW which has very ominous signs of crashing.

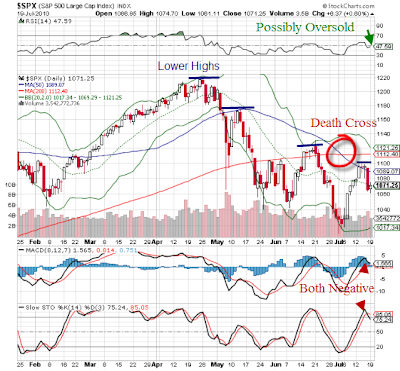

The S&P 500 is in no better shape at all. In fact, both are almost identical graphs. Richard Russell was right on when he warned all to dump stocks and stick with gold and mining stocks.

Even the mining stocks are currently suffering from the crash mode of the general markets as you can observe in the GDX graph, below. However, it is a positive sign that the 50 Day MA is above the 200 Day and that the miners are just testing the 200 Day MA. It would be good if they could stay above it.

Gold, too, is suffering, but holding quite well above 1100 and well above the 200 Day MA. It, also, has not broken below the longer term bull market trend line though it did break through the shorter term. Long term, gold will rise in relative value against all FIAT paper currencies. This will become more pronounced as the central banks and governments rush in with a new flood of unbacked currencies to head off the double dip recession/depression.

From LewRockwell.com:

Armed Citizens Prevail. This reports a series of incidents in which armed citizens did prevail in face of attack. Read it HERE.

From MineWeb.com:

South Africa's besieged mining sector

Faced with all manner of difficulties from cost containment to currency pressures, South Africa's mining sector deserves respect, in place of government's short sighted caprice.

This may be a reason for the African miners to be behind many other mining stocks. It is seen in the prices with DROOY below 5.00 and HMY below 10.00. These are decent buying ranges for my portfolios, but I am slow to buy in this environment of crash mode. Read it HERE.From MineWeb.com:

Volatility creates big opportunities. Hold gold as insurance - Rick Rule

That the markets will deliver huge waves of volatility as the secular commodities bull market continues its charge is a foregone conclusion, as Rick Rule sees it.

Read it HERE.From MineWeb.com:

Short term price outlook for gold and silver

The VM Group/ABN Amro's latest metals report takes a fairly conservative view on the prospects for gold and silver prices in the short to medium term.

Read HERE.From MineWeb.com:

Double dip or recovery - Has gold had its day?

Whether we are entering a double dip recession or a mild recovery gold will perform well in both scenarios.

Read it HERE.From James Turk in FMGR.com:

Waiting for Silver’s Upside Breakout

It will come, but when is the question. This is a good read and has a great graph with it. HERE.

From Seeking Alpha.com:

0 Comments:

Post a Comment

<< Home