WWIII? - Nuclear Leakage in Japan - Miners up with Gold & Silver - Swiss Franc & Norwegian Krone Up

Folks, The disaster saga continues and may actually be spreading. It has hit the currencies as mentioned below, but the human suffering and need is great. We know that the Lord has a purpose in even this. Thus, we must pray, not only for those in need, but to the Lord to ask for understanding and what we are to learn from this event. Remember all things work together for the eventual good of His people.

Bloomberg:

Japan Nuclear Crisis Deepens on Suspected Reactor Breach

Tokyo Electric Power Co. said a reactor containment vessel may have been breached at the crippled Fukushima Dai-Ichi power plant, deepening Japan’s nuclear crisis and increasing the risks of radioactive leaks. The disaster expands. HERE.

The Daily Pfennig (Pfennig@EverBank.com)

“We all should play our parts, so we shouldn’t use electricity if it isn’t necessary,” said Masakazu Yoshida, an administrative official at Nippon Television City Corp., which operates the structure. “We know the tower is symbolic so it was really tough to make the decision to turn it off.” Another problem created by the tragedy in Japan. HERE.

From Town Hall:

Blacks and Republicans

Thomas Sowell:

San Francisco's irrepressible former mayor, Willie Brown, was walking along one of the city's streets when he happened to run into another former city official that he knew, James McCray.

McCray's greeting to him was "You're 10."

"What are you talking about?" Willie Brown asked.

McCray replied: "I just walked from Civic Center to Third Street and you're only the 10th black person I've seen."

That is hardly surprising. The black population of San Francisco is less than half of what it was in 1970, and it fell another 19 percent in the past decade. HERE.

From Town Hall:

Continuing Stubborn Ignorance

Walter E. Williams:

Within the past decade, I've written three columns titled "Deception 101," "Stubborn Ignorance," and "Exploiting Public Ignorance," all explaining which branch of the federal government has taxing and spending authority. How can academics, politicians, news media people and ordinary citizens get away with statements such as "Reagan's budget deficits," "Clinton's budget surplus," "Bush's budget deficits and tax cuts" or "Obama's tax increases"? Which branch of government has taxing and spending authority is not a matter of rocket science, but people continue to make these statements. The only explanation that I come up with is incurable ignorance, willful deception or just plain stupidity; if there's another answer, I would like to hear it. HERE.

Lew Rockwell:

Marc Faber: QE18, WWIII Coming

Marc usually has good insight into world politics and economics. Read it HERE.

Best, Doug

Bloomberg:

Japan Nuclear Crisis Deepens on Suspected Reactor Breach

Tokyo Electric Power Co. said a reactor containment vessel may have been breached at the crippled Fukushima Dai-Ichi power plant, deepening Japan’s nuclear crisis and increasing the risks of radioactive leaks. The disaster expands. HERE.

The Daily Pfennig (Pfennig@EverBank.com)

"Good day. The Japanese crisis continues to dominate the news stories, as 4 of the 6 reactors at the Fukushima power plant remain unstable. Radiation level increases have been reported as far south as Tokyo, but Japanese officials say the levels outside the nuclear facility are not dangerous. The unstable conditions at the Japanese nuclear plant, combined with more violence in the Middle East increased volatility in the markets. Currencies, Metals, and most Commodities had an incredibly volatile day with many investors shifting back into the 'safe haven' of US treasuries."

Bloomberg:

Tokyo Tower Goes Dark as Sony, Asahi Brace for Power OutagesTokyo Tower and its adorning 176 floodlights have illuminated the world’s richest city from sundown to midnight for the past 22 years. Tonight, the 1,093- foot beacon will go dark for a fifth day.

“We all should play our parts, so we shouldn’t use electricity if it isn’t necessary,” said Masakazu Yoshida, an administrative official at Nippon Television City Corp., which operates the structure. “We know the tower is symbolic so it was really tough to make the decision to turn it off.” Another problem created by the tragedy in Japan. HERE.

From Town Hall:

Blacks and Republicans

Thomas Sowell:

San Francisco's irrepressible former mayor, Willie Brown, was walking along one of the city's streets when he happened to run into another former city official that he knew, James McCray.

McCray's greeting to him was "You're 10."

"What are you talking about?" Willie Brown asked.

McCray replied: "I just walked from Civic Center to Third Street and you're only the 10th black person I've seen."

That is hardly surprising. The black population of San Francisco is less than half of what it was in 1970, and it fell another 19 percent in the past decade. HERE.

From Town Hall:

Continuing Stubborn Ignorance

Walter E. Williams:

Within the past decade, I've written three columns titled "Deception 101," "Stubborn Ignorance," and "Exploiting Public Ignorance," all explaining which branch of the federal government has taxing and spending authority. How can academics, politicians, news media people and ordinary citizens get away with statements such as "Reagan's budget deficits," "Clinton's budget surplus," "Bush's budget deficits and tax cuts" or "Obama's tax increases"? Which branch of government has taxing and spending authority is not a matter of rocket science, but people continue to make these statements. The only explanation that I come up with is incurable ignorance, willful deception or just plain stupidity; if there's another answer, I would like to hear it. HERE.

Lew Rockwell:

Marc Faber: QE18, WWIII Coming

Marc Faber provided his latest views on the markets and global economy this morning in light of the nuclear crisis in Japan.

In a CNBC interview, the editor of The Gloom, Boom & Doom report made a bevy of predictions – which included many more rounds of quantitative easing (up to QE18), and eventually World War III.Marc usually has good insight into world politics and economics. Read it HERE.

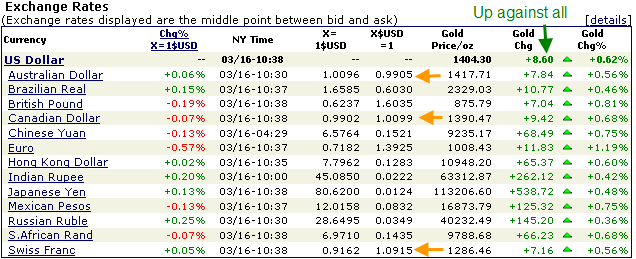

Of course, the situation in Japan and the mid-east are having a great impact upon currencies. Japan will be using dollars from their reserve stash to repair the nuclear plants and infrastructure. So the dollar will receive another blow to its value. Both the Swiss Franc and the Norwegian Krone have benefited from a rush to safety. The U. S. Dollar received attention, as well.

I believe all markets were oversold. Gold and silver are reeling from the over reaction of yesterday, but have recovered a bit today. Even the DOW, though currently down some 65+ at this point is showing a slowing of the downward sprinting of yesterday. The miners are mixed today with many up.

Miners from Scottrade: Most are rebounding slowly, but at least rebounding.

Currencies from KitCo:

Some Prices: FVITF 5.0453 (rebounding nicely); BULM 1.43; OLVRF 1.7105; SENY 1.06; BYDDF 4.10; DOW off 43+ to 11811.37; SPX off 2 to 1280+; Gold up 8.80 to 1404.50; Silver

0 Comments:

Post a Comment

<< Home