Gold Touches New High - New look at Fortuna - Silver - Miners - Currencies - Swiss Franc on the move

Once again, I am holding and biding my time resting in the Lord as He reveals the true direction of the markets as days go by. It is an exciting, but challenging time with the dollar taking hits. The economy is not nearly as great as the USG would have us believe and it seems that investors are beginning to catch this truth.

Mine Web:

China's increased dominance of global commodities market carries risk-S&P

As China becomes the dominant presence in global commodities markets, S&P feels downside scenarios are unlikely to occur, "but the shocks will be felt around the commodities world." HERE.

Mine Web:

This year, it may pay gold investors to hang around in May

The next few months are likely to see gold continue higher on the back of continued concerns about debt, not just in Europe but also the US after which a modest correction is on the cards. I did not sell in May and run away. I am still holding and waiting. HERE.

Mine Web:

Fortuna Silver achieves better than expected start-up production rate

The Canadian miner said it has reached a start-up production rate of 1,000 tonnes per day as opposed to the expected 750 tpd and expects to more than quadruple metal production by 2019. This is good news for my "Ever Ready Bunnie." Fortuna has been one of my long term holdings which has really done well for me. During the course of the last year, I had sold some, but have re-bought most of it and have a large holding. HERE.

If you are a long term investor, it is likely that you are holding on to your mining stocks and precious metals, as am I . These prices will not always hold. It seems that the prices do respond to the growing demand for the metals. sovereign wealth funds, mutual funds, central banks, and other deep pocket investors are beginning to stock up on physical metals in competition with individuals. Thus, the long range perspective of the metals is upward.

The major detractor to the upward move of the physical metals has been the playing with the paper metals in the futures market by several not for profit entities. They still hold shorts in the paper markets and a vested interest in keeping the prices from achieving the normal level. At some time, it will be impossible for them to contain the prices, as they have been able to do, thus far.

Gold in spite of the War Against Gold pushed to a new high briefly over night. It was a very brief encounter of the intervention kind. The Federal Reserve and the USG cannot allow gold to attain the high prices demanded by the depreciated dollar and the growing demand for the metal. It would completely destroy their smoke and mirrors of the Fiat currency system of the world today. However, gold is becoming more of a monetary metal in spite of the War.

Resource Investor:

Gold & Silver: The Long March Upward Resumes

Just a few weeks ago, gold and silver prices were soaring, almost beyond belief. A growing chorus of investors, analysts, and financial journalists opined that the “bubble” in precious metals prices would soon pop – and many predicted an imminent long-term bear market was just around the corner. HERE.

Miners from Scottrade:

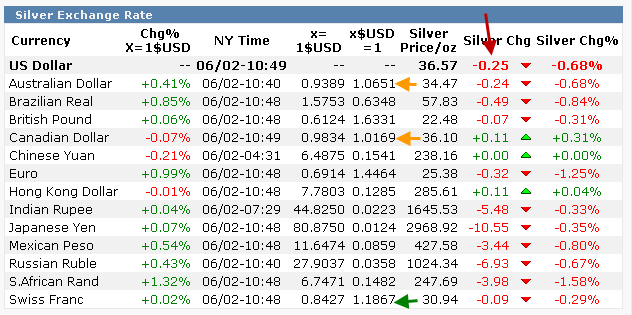

Currencies from Kit Co: Note the strength of the Swiss Franc against the dollar)

Some Prices at 10 am: DOW down 41.75 to 12247.27; S&P down 2.77 to 1311.64; NASDAQ up 2.76 to 2771.97; Gold off 13.50 to 1524.710, and Silver off 0.95 to 25.87. (I am not buying the metals or miners at the current time, but it could be the correct thing for some to do in consideration of their individual portfolios and cash position. Check it out and make your decisions.)

0 Comments:

Post a Comment

<< Home