Man does not live on bread alone - All markets starting up - Precious Metals Recovering - Miners on Rampage - Dollar Down

Christ told us during His earthly ministry "Man does not live on bread alone, but on every word that proceeds from the mouth of God." The word of God is the source of truth. It tells us that the fear of God is both wisdom and knowledge. James tells us in his book that if we lack wisdom, we are to ask it of God and He will supply it. It comes from a deep study of the word of God under the guidance of the Holy Spirit. Let us praise Him daily.

MineWeb:

Gold's financial role likely to expand - Lassonde

Franco-Nevada Chairman, Pierre Lassonde says he remains very bullish on the prospects for gold over the next 10 years but does not rule out the potential for a significant correction within the bull market. HERE.

Gold rises on Slovak vote, weak dollar

Slovakia's stance not to expand the euro zone's rescue fund pushed save haven investors back toward gold, which rose 1% in Europe on Wednesday as the dollar fell against the euro to a three-week low. HERE.

Gold and silver both showing good strength overnight and this morning

Gold seems to be finding a floor which is encouraging Asian buyers to resume purchases at what they feel may prove to be bargain prices as the Eurozone moves from crisis to crisis. HERE.

Hecla Mining pays record $77.5m partial settlement to U.S. Feds

As part of a June settlement to clean up historic mining contamination at the Bunker Hill Superfund site, Hecla Mining has made a record partial payment to the U.S. Government. Perhaps, this is why most miners have moved out of the US. Too costly to operate with the environmentalist on the rampage and the Federal Government supporting them very strongly. HERE.

KingWorldNews:

Embry - If We Repeat 2008, Stocks Could Fall 40% From Here With

gold holding near the $1,650 area and silver around $32, today King

World News interviewed John Embry, Chief Investment Strategist of the

$10 billion strong Sprott Asset Management. When asked about events

around the world and how they are impacting gold and silver, Embry

responded, “This Dexia Bank failure just showed how vulnerable

the European banking system is. This was one of the banks that stood

out in their stress tests and then two months later they have to

recapitalize it and nationalize it. This probably brought home to

people that we are talking trillions of euros to recapitalize the

banking system over there to keep it functioning.”

John Embry continues:

“That money printing is an

extraordinarily bullish event for gold. If gold weren’t manipulated the

way it is, it probably would have been up $100 on that news. Gold was

mercilessly pounded at the end of last week, so gold is still getting

kicked around, but it’s building a base and the next move will take it

comfortably through $2,000.

Gold needed a correction

after the big run it had, but it was the way it was done that was the

big tip off. They (central planners) manufactured a correction for many

reasons, one being the European banking situation and the general

economic conditions. Just as importantly, I think the paper guys have

to get their short positions down because they know what’s coming.” HERE.

GATA:

Another version of the 'stump speech' on gold price suppression

The third or fourth incarnation of what has become your secretary/treasurer's "stump speech" on gold price suppression was prepared yesterday for a dinner of financial people in London that may have been most notable for one fund manager's disparagement of GATA's work. Why are we complaining about manipulation of the gold market, he asked, when everyone knows that governments these days are manipulating all markets? Brief and interesting. HERE.

Politico:

Lackluster economy could lead to next gold rush

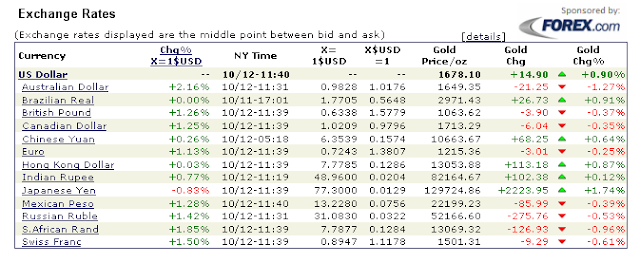

Some Prices: DOW up 124.69 to 11541.14; S&P up 16.66 to 1212.20; NASDAQ up 33.38 to 2616.41; Gold up 14.20 to 1677.40; Silver up 0.44 to 32.58.

Some Prices: DOW up 124.69 to 11541.14; S&P up 16.66 to 1212.20; NASDAQ up 33.38 to 2616.41; Gold up 14.20 to 1677.40; Silver up 0.44 to 32.58.

Best to each, Doug

0 Comments:

Post a Comment

<< Home