Dollar Collapse? - Decline & Fall of American Empire? - Men Must Return to Kingdom Work Within the Families & Churches

Folks, We are seeing America being defeated from within. God's call for repentance has largely gone unheeded. How long will King Jesus have patience for us? This is the real question that each of us must answer in his own mind as we study and are guided by God's written word which He has graciously protected for us throughout centuries.

Pray for revival in the individuals, in families, and in churches. This must start, but Christian men taking their God-given place as Federal Heads of their families and shoulder their responsibilities to lead, protect, and education from scripture each family member. Without Godly men, our nation is lost.

Reuters:

China official says U.S. could pursue weak dollar policy

China should guard against risks from "excessive" holdings of U.S. assets as Washington could pursue a policy to weaken the dollar, a senior currency regulator said in comments published on a website that briefly pushed the dollar lower.

However, the comments by Guan Tao of the State Administration of Foreign Exchange were quickly removed from the website at his request. He told Reuters the comments had been made in private academic discussions and represented his personal view only. Old, but interesting news. HERE.

The Daily Pfennig (Pfennig@Everbank.com) "So. we had some strange occurrence move Gold down $13 in a matter of minutes. I'm sure the boys and girls over at the CFTC (Commodities, Futures, Trading Commission) will tell you that it was just a co-ink-e-dink! But I'm not buying that swamp land they are trying to sell. and it just ticks me off to no end, that nothing is done about this stuff!" GATA has been publishing such information for years now. The War on Gold and Silver continues. God is using this as part of His call to repentance. He has taken away our "free markets," and given us manipulated markets. Actually, our markets have not been truly free for many decades, but they were much freer early in our history as a nation.

Mine Web:

Three reasons why gold is going to have a big summer - Embry

As concerns grow once more about the health of the global economy and the nature of gold demand shifts, so the yellow metal is likely to shrug off its traditional summer funk. Possibly, but the action of gold and silver seems to be fulfilling the historical doldrums summer scenario. We seem to be headed for a real buying opportunity in the metals which has spilled over into the miners which are failing to respond to the higher prices of the metals. HERE.

Mine Web:

What happens to gold if the dollar collapses as the U.N. suggests?

Now the U.N. warns of dollar collapse. If it happens how ill it materialise and what would it mean for the price of gold? Should this happen, the price of gold in dollars would be astronomical. However, that would not mean that we profit from the dollar collapse, but that wealth would be preserved in gold and silver. HERE.

Mine Web:

Change in Indian gold purchasing see year-round demand

Julian Phillips' daily comment on the state of the global gold and silver markets after London's morning trade and his observations on the market in general. That is interesting. Perhaps, they are seeking the security of gold, but not just in the gift season. HERE.

Guardian:

Decline and fall of the American empire

The economic powerhouse of the 20th century emerged stronger from the Depression. But faced with cultural decay, structural weaknesses and reliance on finance, can the US do it again?

America clocked up a record last week. The latest drop in house prices meant that the cost of real estate has fallen by 33% since the peak – even bigger than the 31% slide seen when John Steinbeck was writing The Grapes of Wrath.Unemployment has not returned to Great Depression levels but at 9.1% of the workforce it is still at levels that will have nerves jangling in the White House. The last president to be re-elected with unemployment above 7.2% was Franklin Delano Roosevelt. America is certainly loosing its empire from within. Not unlike the crumbling of the Roman empire. HERE.

King World News - Blog:

Jim Sinclair - Gold to Exceed $12,500 to Balance US Debt

With continued volatility in gold and silver, today King World News interviewed the legendary Jim Sinclair to get his take on the markets. Sinclair surprised KWN by discussing a price target for gold that to some would seem unimaginable. When asked about trading for gold this summer Sinclair stated, “I think most of your analysis of secular trends will look and say no, no, summer time doldrums nothing happens. Well we could have something very significant happen and for a very clear reason. It’s becoming obvious even to our talking heads that this great recovery which we’ve questioned for a considerable period of time is in fact more in people’s minds than in reality. The economy is turning down again and turning down hard, there’s no question about that.” HERE.

Town Hall:

Irksome Things

Walter E. Williams:

There are a lot of things, large and small, that irk me. One of them is our tendency to evaluate a presidential candidate based on his intelligence or academic credentials. HERE.

Gold has begun to outpace silver. Also, we notice that the miners are not adjusting to the higher level of metal prices. Certainly, the metals have decreased in price, but they are trading at a higher plateau, bu the miners do not follow, yet. When the gold rush really gets hot, the miners will be the pace setters, due to the leverage they provide.

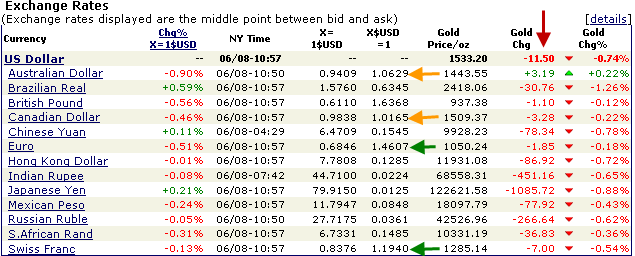

Currencies from Kit Co: Note that Swiss Franc and Euro are strong against the dollar.

Some Prices: DOW up 21.38 to 12091.93; S&P up 1.65 to 1286.60; NASDAQ down 6.14 to 2695.36; Gold off 7.50 to 1537.20; Silver off 0.58 to 36.56.

Best to each, Doug

0 Comments:

Post a Comment

<< Home