New Year Resolutions That Work! - Mining - Currencies - Inflation - Banks Failing Still

We should daily thank King Jesus for the seasons and calendar changes. It is true that even during our corporate worship on the first day of each week, we should see the new week as an opportunity to renewing our efforts to be more pleasing to Him. Now we are coming upon the New Year.

Check out Bloomberg for an interesting view of top stories. The second is showing how Sweden is more correctly fighting inflation. They are off on a much better path than the rest of the world. HERE.

From The Street:

Gold Prices Knock Around $1,400

Gold for February delivery was down 40 cents to $1,405.20 an ounce at the Comex division of the New York Mercantile Exchange. The gold price Wednesday has traded as high as $1,410 and as low as $1,401.50. HERE,

From Kitco News:

Market Nuggets: Metals Correction Possible In Early 2011 – MF Global

29 December 2010, 9:49 a.m. HERE.From Kitco News:

A.M. Kitco Metals Roundup: Narrow Range Trade, U.S. To Sell 7-Year Notes

29 December 2010, 08:03 a.m. HERE.

From The Daily Pfennig (Pfennig@EverBank.com): "Speaking of smoke and mirrors. How about the game being played where the media bangs on the European periphery countries (and rightly so) for their debt problems, but let's the U.S. go Ollie, Ollie, Oxen Free on their debt problems? Remember 2009, and the 140 banks that closed, and the media said that the worst was over? Well, think again. the bank closures in 2010 will show that 140 was chump change! 157 banks were closed this year. That's the worst year since 1992 (after the S&L crisis). This is what happens when you have a government spending led economy, high unemployment, and a housing sector still devastated, and in shambles. Just for comparison. in 2006, there were no bank closures!" I sure am glad that the economy is beginning to boom if you believe the government statistics and rhetoric. Of course, this is in spite of the very heavy under, part time, and unemployment, bank failures, housing problem, expensive wars, excessive spending by governments, and vast debt. The economy is a long way from booming if ever.

From The Telegraph:

The UK inflation genie is out of the bottle

As 2010 draws to a close, it's becoming ever clearer that the UK's economic prognosis is not good. I believe it to be coming out of the bottle in America, as well. As I shop, I continually see a creeping price inflation. Are we headed toward hyper-inflation. That is possible, but not immediately. Read the article HERE.

From Bloomberg:

Preference for Gold Savings Among Turks Surges, Hurriyet Says

Perhaps, they know something which has yet to be on the radar of most Americans. The present higher prices of the precious metals here may be reflecting, not only short covering, but growing interest of citizens. It seems to be seen by at least a few of us. HERE.

Gold pushing beyond a new high. Currently 1410+. Silver, also pushing for new bull market high!

Both are sprinting ahead. Guess I should have bought more of the metals and miners a few days ago when I said it was a potential buying opportunity. Monday morning quarter backs can see the game more clearly and make corrections, but then it is a bit late. Here am I.

Miners from Scottrade:

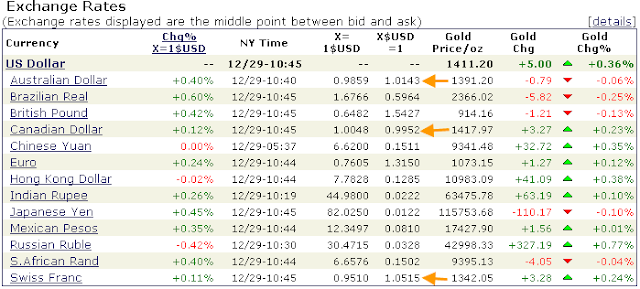

Currencies from Kitco:

Some Prices: FVITF 4.55; OLVRF 1.3984; HHWW 1.67; FRXP 0.3254; TBT 39.0917 (LT Treasuries down a bit) DOW up 35 to 11610.31; SPX up 3.17 to 1261.68; Gold up 4.50 to 1410.70; Silver up 0.29 to 30.58.

Best to each, and a Holy New Year to each, Doug

0 Comments:

Post a Comment

<< Home