Hyperinflation - Dry Baltic Index - ?Buy at these Prices? - Miners - Precious Metals

Folks,

In a very real sense, unbacked paper currencies are a fraud against those from whom we purchase goods and services. Our dollar is a "Federal Reserve Note." It is not money, but an IOU. The transaction is not complete until the "Note" is paid.

Nations and governments are often found to be in violation of God's Law. Many nations and cities have been destroyed by the wrath of God when He tires of their disobedience. Will the USA go the way of these or will we turn in repentance to the God through whom we have been blessed in our founding and since by His providence. Let us purpose to and follow through with our repentance and, perhaps, King Jesus will relent and restore our nation.

From James Turk at Free Gold Money Report:

Not Only Commodities are Signaling Hyperinflation –

January 15, 2011 – The rise in commodity prices over the past several months has been unrelenting. Equally unrelenting has been the stream of central bank apologists aiming to re-direct the blame for soaring prices to almost everything imaginable except the real cause, which of course is unrestrained money printing. Catch it and view the graph HERE.

From Bloomberg:

Dry Bulk Ship-Use to Drop to Decade-Low, Pareto Securities Says

Dry bulk ship-usage will drop to the lowest level in a decade by next year because the fleet is expanding faster than cargo growth, Pareto Securities AS analysts led by Martin Korsvold in Oslo said in an e-mailed report today. And the recovery continues??? Another mis-allocation of funds to build too many ships, just as was the case in over seas manufacturing. It always happens with easy credit and increasing the unbacked paper money supply. HERE.

From GATA:

Adrian Douglas: Strong indications of gold and silver shortages

In his new statistical study, GATA board member Adrian Douglas, publisher of the Market Force Analysis newsletter, reports that gold and silver futures market data show growing shortages of the metals, as open interest is losing its correlation with price. HERE.

From Yahoo Finance:

Sell Gold, Buy Silver

You may have noticed that gold is hovering around $1,360 an ounce (sliding recently after a big run-up) and silver is around $30 an ounce. That means in November of 2010 alone, gold increased in price by 2 percent and silver by 14 percent. Investing in gold and silver beats saving money in a bank earning less than 0.1 percent per month. Once again, this is further evidence that savers are losers as central banks of the world print trillions of dollars. This is a very interesting article. It is worth the read and consideration. I'll have to think this one through.I do believe that silver will out perform gold in the long run. HERE.

From Mine Web:

There's no substitute for gold as the world order changes

The currency debate is just another element in the rapidly changing global economic power battle, but of all commodities gold is likely to be the most consistent beneficiary. This is true, but poor man's gold, silver, it a great wealth preserver, as well. HERE.

From Mine Web:

Gold stocks excellent value at current metal price - Hathaway

At the current gold price gold mining companies are reporting good earnings, increased dividends and are thus providing excellent returns for the investor says renowned gold analyst John Hathaway. I must admit that the prices are inviting, but I am not ready to be buying at these prices. Still have a sizable position in many, but might add at lower prices. HERE.

From Kit Co News:

A.M. Kitco Metals Roundup: Comex Gold Higher on Bargain-Hunting, Weaker U.S. Dollar Index

18 January 2010, 08:25 a.m.

By Jim Wyckoff

Of Kitco News

Comex gold futures prices are trading higher Tuesday morning, on a corrective bounce and some bargain-hunting buying interest following recent selling pressure. A lower U.S. dollar index Tuesday is also providing buying support for the precious metals markets. February Comex gold last traded up $8.00 at $1,368.50 an ounce. Spot gold last traded up $7.10 at $1,369.00. HERE.

Miners from Scottrade:

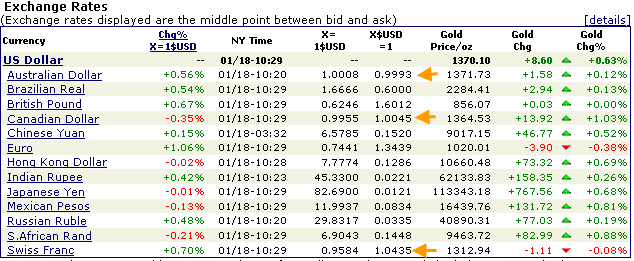

Currencies from KitCo:

Sme Prices: FVITF 4.3529; BULM 1.06; OLVRF 1.264; HHWW 1.86 (Would like to buy some of this at about 1.70); TBT 39.51 (LT Bonds down a bit); DOW up 43.40 to 11831.2; SPX down 1.35 to 1292+; Gold 1369.9 up 8.40; Silver up 0.63 to 28.94.

0 Comments:

Post a Comment

<< Home