Rejoice as Paul did in the Lord - Gold - Silver - Miners - Currencies -FVITF

Paul, that is, the Saul who became Paul on the road to Damascus through the power of Jesus Christ must have been a very joyful man as he ministered where Christ sent him. In Philippians 4:4, he wrote, "Rejoice in the Lord always; again I will say, rejoice!" Then he wrote in 1Thessalonians 5:16-18, "Rejoice always; pray without ceasing; in everything give thanks; for this is God's will for you in Christ Jesus."

From Mine Web:

Gold's run not yet finished

Despite glimmers of hope for the US economy in particular, the global economy is likely to face further problems and gold prices will go higher. The global, including the U.S. economy continues to face problems in spite of the rhetoric on our recovery, so gold will come into its own as the bull market continues. There "ain't" no recovery without unemployment improvement other than BLS manipulation of the reporting data to lower unemployment. Remember that employment improves every time another unemployed person runs out of unemployment payments, but he remains unemployed. Also, there are other manipulations to conceal the true situation. HERE.

From Mine Web:

Gold hovers near $1,370 on euro zone concerns

Growing pressure on Portugal to seek financial aid has reignited concerns about euro zone sovereign debt which helped push prices of the yellow metal higher. Perception of the investors is of greater importance that reality. People would rather hear good news than bad, so they jump at each bit, thereof. Also, the concerns over the euro zone debt seems to me to be blown out of proportion. Reality would force one to look at the problem in several of our larger states which are much greater than those of Europe. Also, perception causes investors to look beyond US debt problems which are the greatest in the world. HERE.

From Mine Web:

Outlook for gold in 2011: Fear and Love in Gold Trading - Holmes

Frank Holmes reckons the gold price will double over the next few years due fear of economic meltdown and love in the emerging nations with their propensity to accumulate gold. Here is an article which is pro gold from a respected speaker who represents a company with a vested interest in gold. I see him as being somewhat conservative at this point in time. HERE.

From Mine Web:

2011 expert gold, silver pgm forecasts all bullish - LBMA

The LBMA has published the listings of expert analysts' annual forecasts for precious metals prices in 2011 and this year, without exception, all are bullish. Both silver and gold remain in strong bull markets. I tend to favor silver for a percentage wise catch up and passing gold. HERE.

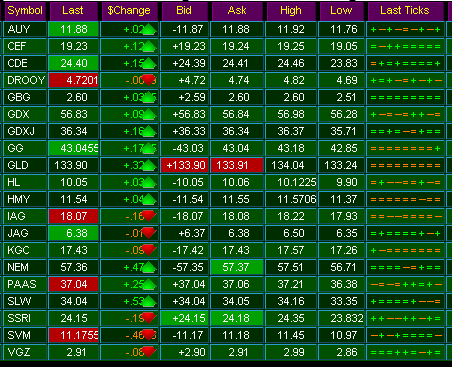

Miners from Scottrade:

Currencies from KitCo:

I bought FVITF during the current correction at about 4.40 and hope to get some more:

Some prices: FVITF 4.3485; OLVRF 1.3465; SILA 0.031; HHWW 1.72 (Holding well 1.70-1.73; TBT 37.99 (down showing that LT treasuries are a bit higher; DOW off 74.66 to 11600; SPX off 6.68 to 1264.53; Gold down 0.80 to 1369; Silver up 0.28 to 28.97.

0 Comments:

Post a Comment

<< Home