Markets Undecided - Dollar neutral - Currencies Up a Bit - Gold and Silver holding well - Economy still stinks. - A Contrary View

The Oil and Gas Guy:

Dollar’s On the Verge of a Relief Rally Look Out!

Let’s talk about the dollar for a moment… The US Dollar has been stuck in a very large trading range during the past 4 months. But when the dollar actually breaks out of this pattern in either direction we should see some big price movements across the board in stocks and commodities.

From July through mid-August I was bearish on the dollar. But over the past 2 weeks the price action has become more neutral/bullish in my opinion. Its clear there is still indecision with the dollar value because every surge in price either up or down is quickly followed by a surge in the opposite direction. The key here is that the support level down at the 73.50 area has held more than three times and now I think the downward momentum is about to shift. Here is an article which should make us think and beware. This is a contrarian view in my mind, but he makes a lot of rational sense. I just continue to examine the fundamental economic problems world wise and believe that certainly longer term we will see more of the financial fiasco. I could be wrong! The graphs are worth the read. HERE.

Mine Web:

Mining company debt at all-time low; cash flow, profitability at all-time high-E&Y

In the first half of this year, mining and metals companies completed 19 megadeals in excess of US$1 billion, twice as many as during the same period last year, while IPO volume increased 30% over the same period. This is good news and one would expect it to be reflected in the miners prices very soon. HERE.

Fiscal policy, and the end of gold's correction - Murenbeeld

Dundee Wealth Economics cheif economist, Martin Murenbeeld, takes a look at the possibility of a bank collapse in Europe, fiscal policy going forward and why a return to a gold standard is unlikely. This is an interesting Pod Cast. HERE.

Gold to continue rising as the need for further liquidity measures grows

As the US and Europe continue to struggle with ways to shore up their respective economies, Martin Murenbeeld believes that gold is likely to continue upward. HERE.

Gold price steadies in Europe; U.S. Fed policy awaited

Gold prices in Europe recovered on Thursday, up from earlier lows after regional stock markets slipped at the open and as investors await U.S. Federal Reserve’s decision amid talk of fresh easing. HERE.

Miners from Scottrade:

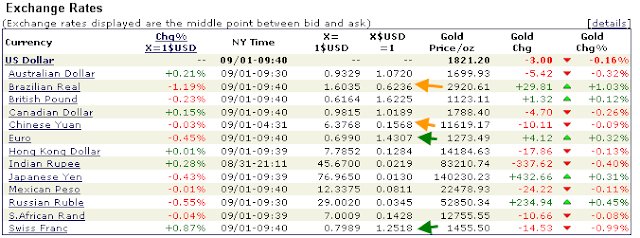

Currencies from KitCo:

Some Prices: DOW off 28.76 to 11587.34; S&P off 4.56 to 1214.31; NASDAQ up 03.35 to 2579.91; Gold up 1.80 to 1826.00; Silver off 0.16 to 41.45.

0 Comments:

Post a Comment

<< Home