Judgment Day Will Come! - Silver Wheaton - IAMGOLD - Dollar Up - Metals Down - Taxation of Corporations? -

We must always remember that we cannot trust governments which are run by men who are ignorant of the Law-Word of God or fail to apply it to all of their service in government. Men are forever changing while the law of God is forever the same.

When people, families, churches, or governments ignore the law of God contained in both the Old and New Testaments, the result is chaos. So called "New Testament Churches" often ignore the application of God's law as passe except for the Ten Commandments. It is very difficult to apply God's law without the insight of the Old Testament examples of civil laws and corresponding punishments for violations. We cannot please God without having Godly law for civil governments as contained in the Old Testament. Much of common law and even the aborted laws of today reflect these in principle.

King Jesus rules and is through His body, the church of today, is taking dominion until all the nations are under His foot. Then He will deliver them to the Father and we shall all appear before the Great White Throne of judgment. We must praise Him daily for reconciling His people with the Father before the final day. Rejoice in the Lord always, and again, as Paul wrote, rejoice!

Town Hall:

|

Ignorance Exploited Walter E. Williams |

Kit Co News:

|

A.M. Kitco Metals Roundup: Comex Gold Sees Modest Selling Pressure As EU Debt Crisis Escalates 09 November 2011, 8:00 a.m. By Jim Wyckoff Of Kitco News |

Reuters:

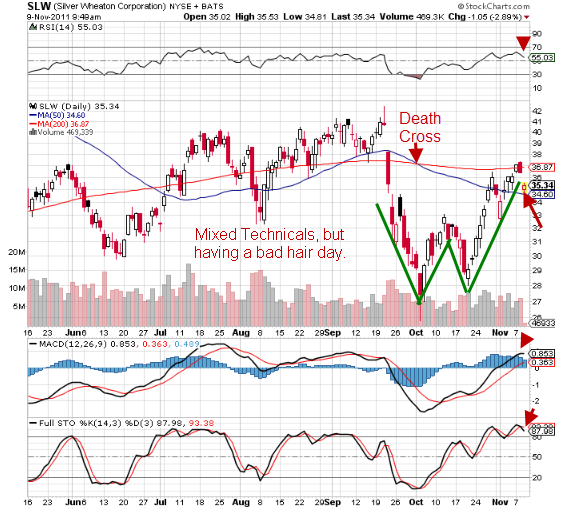

UPDATE 1-Silver Wheaton Q3 profit jumps; raises dividend

Silver Wheaton Corp reported a 96 percent jump in third-quarter profit, driven by strong silver prices, and the company tripled its dividend for the current quarter.

The company has linked dividend payments to operating cash flows in the prior quarter and will now pay a dividend of 9 cents per share in the fourth quarter. Another of my core holdings among silver miners. HERE.

Mine Web:

Have gold stocks really underperformed bullion?

Major and

mid-tier gold stocks have mostly kept up reasonably well with the

rising gold price over the past three years, but the market wants more,

so will this come about with the big earnings increases now being

achieved. HERE.

Gold falls on strong dollar, Italy debt fears mount

Gold fell

from Tuesday's high of $1,802.60, its strongest since late September,

on Wednesday as the dollar strengthened and doubts about Italy's ability

to tackle its debt problems persisted. HERE.Gold to average $2025 an ounce during very volatile 2012 - HSBC

HSBC analyst, James Steel says the group expects the yellow metal to trade between $1,700 and $2,300 next year as safe haven buying returns and the risk on, risk off scenario continues. This is certainly quite possible. I still look for gold to be about 2000 by year end. However, it continues to struggle against intervention and profit taking, so it could miss my expectation. HERE.

IAMGOLD reports 182% in 3Q11 adjusted net earnings

IAMGOLD announced that its adjusted net earnings for the first nine months of this year increased 186% as 3Q11 adjusted net earnings rose 182%. Another core holding. HERE.

Miners from Scottrade:

Currencies from Kit Co:

Metals Prices: Gold up 1.20 to 1786.30 and Silver down 0.44 to 34.46. Silver is beginning to see more retail buying of the metal. It is the "poor man's gold." Can it be that some of the masses are seeing the light? Gold demand remains strong, too.

0 Comments:

Post a Comment

<< Home